The following is a post from our series of articles on How to Buy Your First Rental Property. If you would like to see more of these posts or learn about our upcoming video course, then please view our course page.

When you invest in residential real estate, you generally deal with two types of buyers: Nesters and Investors.

Nesters buy real estate to live in. Nesters value their property based on quality of life factors such as the safety of the neighborhood, the work commute, the quality of nearby schools, and the property’s proximity to stores, entertainment, etc. These quality of life factors are so important that some nesters are willing to buy a home at a premium or buy a home that’s above their budget (which can strain their finances).

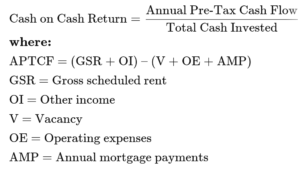

While Nesters tend to focus more on qualitative factors, Investors tend to focus more on quantitative factors. Investors usually value property based on the potential cash flow the property generates. If the property doesn’t reach their Cash on Cash Return goals then the investor will not go through with the purchase. You can find the formula for determining cash on cash return below:

When investors analyze properties, they often focus solely on quantitative factors. This can cause them to blind themselves to the reality of the property at hand.

Missed Opportunities

A few years ago I was talking to a group of real estate investors at an investor meetup. I met Greg and Tom who started investing in Sacramento real estate after the financial crisis. At that time, real estate was selling at a deep discount. In certain areas of Sacramento, prices were down more than 60! Greg, Tom, and I both decided to invest in different areas. The area I invested in had solid returns, but not as high as the returns of the area where Greg and Tom invested. They focused on the numbers and closed a buy and hold deal with a potential 20% percent cash-on-cash return, which is considered a fantastic rate of return.

The problem is they ignored the qualitative factors that drive real estate returns. They purchased properties in the middle of a high crime area of Sacramento. Things were going well for a time, but as soon as the market recovered, vacancies began to rise and they could never find solid tenants. Evictions begot evictions, which led them to sell their properties.

Why did the vacancies increase?

The tenants (Nesters) lived in Sacramento due to the recession. As soon as their incomes rose, they left as soon as they possibly could. As a result, the Investors dealt with frequent tenant churn, theft, and vacancies. Over time, the properties turned into huge liabilities. The investors had a golden opportunity to purchase quality properties at a discount, but instead they picked losers. How did this happen?

How Can Metrics Hurt Our Investments?

Donald T. Campbell created numerous works in the field of social science and psychology. Unfortunately, most of his work isn’t known in the investment community, so I took one of his laws and put an investor’s spin on it.

A Campbell-Inspired Real Estate Law:

“If real estate investment metrics (e.g. return on investment, cash-on-cash return, etc.) are used as the primary reason for investment decisions, odds are the investment will fail.”

Numbers are important, but they are not as important as the investment vehicle generating them.

Metrics are tools. Similar to a compass, they can point you in a certain direction; however, they will never provide you with a complete picture of the lay of the land. A compass won’t warn you about the canyon ahead, tough river crossings, or a dead end. The same goes with real estate investing metrics, cash on cash return won’t tell you that the property you’re analyzing has high cash on cash return because property values are depressed due to rampant crime in your area, a local employer recently filed for bankruptcy, or the property is located in a flood plain.

Post-purchase, if we continue to heavily focus only on the numbers, we will make poor decisions in the short term that can potentially cause long-term losses and more substantial costs.

If we make decisions solely on metrics—such as pushing off a major structural repair or cutting corners with cheap, shoddy work in order to keep costs in line with our projections—eventually we will decrease the value of the asset and reduce its ability to generate cash flow.

How to Pull Yourself Out of the Metrics Trap

Investors should instead focus on three factors that lead to healthy real estate investments.

Neighborhood

Consider the following when assessing a neighborhood:

- Is the neighborhood where the property is located a place people would want to raise a family?

- How safe is the neighborhood?

- If money wasn’t an issue, would people choose to live in this neighborhood?

- Is this neighborhood within the path of economic development?

- Are new businesses being started in the area?

- How are the schools?

Physical Attributes

The physical attributes of property include the floor plan, square footage, lot size, and so on.

Ask yourself these questions:

- Which characteristics of this property will allow you to charge above-market rents?

- Is the floor plan larger than comparable properties in the area?

Tenants

Think about the following with regard to tenants:

- What type of tenants will be attracted to this property?

- Will people with steady incomes, great credit, and clean tenant history want to live in this property?

What is the Best Way to Use Metrics?

We need to start seeing metrics as tools that can help us make decisions as opposed to being the sole determinant of decisions.

Optimally, metrics should be used as a status report on how things are going. They are a tool for tracking trends and discovering relationships between factors, which can then be taken into account as part of the overall decision-making process.