Summary

Sasha Krecinic has been a utility player throughout his career and held a variety of roles ranging from product, consulting, analytics and ops, he now leads the sales and marketing team at HappyCo. Back in Australia he taught Portfolio Theory and Options classes and in this blog post he offers a unique way to apply those concepts to your life/career. This blog is designed to help you better understand options and how they can impact your career and personal life.

Introduction

Options, yolo-ing them to the moon, and WSB. These words garner the headlines of the world from time to time, but the best options strategies are painfully simple and right under our noses. When people hear options strategies they think financial investments, but people fail to realize that each day we are making options decisions in careers, personal lives, etc. that can have a huge impact on our life’s trajectory. During your career you will come across multiple options and opportunities. Which ones do you choose? This blog offers a few ideas and concepts related to options to help you improve your career trajectory and to help you manage your single most valuable asset – You.

But first, strap yourself in for a quick personal flashback.

Prologue

My first memories of this world start at the age of 4 while my family was in a refugee camp in Växjö, Sweden. At the time, Yugoslavia was demonstrating how to wage one of the most horrific wars since WW2. The country was once again center stage in what evolved to be a proxy war between the East and West. Artillery shells rained down on my hometown of Mostar, Bosnia & Herzegovina and with that any trace our family home was turned to dust. Like many families at that time, my parents chose to leave behind everything and seek safety and political stability for their children.

With nothing more than two suitcases and two children my parents emigrated to Australia. Their logic at the time being “the further we are from Europe the better”. They had had two options, stay or leave. They chose to leave and were happy with their choice; but ultimately, they had pressed the reset button on their savings, qualifications, relationships, and even their ability to communicate by moving to a new country.

Starting life from scratch was hard. But, if you think this is a sad story, it isn’t. We were the lucky ones. All alive, healthy, and happy in a land full of opportunity.

Perspective

You might be thinking, “Sasha, what does any of this have to do with investing and Options, let alone careers?”

The oversimplified answer ultimately boils down to ‘perspective’. We were safe, we had food, and the world was our oyster. No job was too small or too big to get you financial security. Painter? Truck Driver? Chef? Translator? No problem, these were all jobs worth doing because they paid rent and put food on the table.

I watched my highly educated and overqualified parents work these kinds of jobs year after year. I never truly understood the significance of learning this lesson from them and the importance of being appreciative of the opportunities we get in life until I was asked after a recent promotion, “how did you come to be in this role?”. I had just been promoted a second time within 6 months into a role overseeing more senior and experienced people which, unsurprisingly, created some confusion. The answer to the question was complicated and beautifully simple at the same time. The simple answer was “just do what you have to do, get stuff done, and leverage the opportunities made available to you”. To explain it in full though would require crossing concepts based on Options strategies, modern portfolio theory, and the perspective of a young refugee, the latter of which you’ve already been subjected to.

Options 101:

Now let’s tackle ‘Options’ quickly. An option is: “the right (but not the obligation) to do something”.

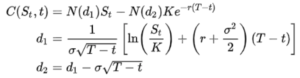

The technical explanation and valuation of Options gets complicated really fast. Don’t believe me? Look at this proof on wikipedia or the hieroglyphics for the value of a Call Option below:

Instead, I offer you an ELI5 explanation of Options.

Generally speaking, Options are more valuable with:

- Probability – the higher the chance of the ‘good’ outcome

- Time – the more time you have for a good outcome to happen

- Volatility – the bigger the payoff the better (this may be counterintuitive but the type of options in this post have little to no downside risk. If the downside is capped and the upside increases, it generally benefits you)

Options in real life:

If we apply this to a real-world example, the variables are more tangible. Let’s assume you’re a software engineer, 28 years old, and want to become a CTO, Co-founder, or a Consultant one day. Where do you begin? What strategy will give you the best chance of success?

How intentional should you be about the path you take to achieve each potential outcome? What if something else comes along and your better path was to pursue one of the other outcomes? How can you maximize your chances to achieve your goals? Based on the variables identified above, you could increase the value of your Options and chances of success by working on the:

- Probability – Maximizing your chance to succeed in your end goals – identify the skills you need and especially the ones that are common amongst the three roles (because you may choose to learn those sooner). This could be as simple as: get mentors, build a good network of friends and colleagues, ask for feedback regularly, not being a crappy person (all the basics a book like ‘What got you here won’t get you there’ will teach you).

- Time – Increase the amount of time you have before you have to make a decision by front loading the skills you need for all three outcomes and maximizing the chance of all three options being viable for as long as possible

- Volatility – dream big! All things being equal, high stakes outcomes are generally worth more than low stakes outcomes! This is where you can use risk to your advantage! Should you be a leader in a growing industry or emerging field vs. a leader in an already established one?

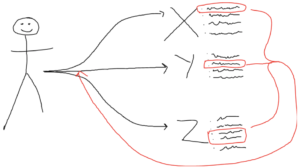

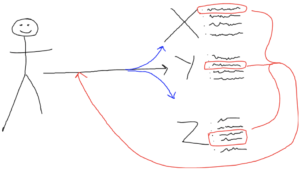

Having the ability to choose your pathway because you qualify for multiple offers over the space of many years is a very fortunate position to be in and one that allows you to navigate through life until YOU choose to change direction. To help visualize this, here is an artistic rendering of this playing out.

Step 1: Identify what you want to be when you grow up: Pick three things you want to be when you grow up and find ways to maximize the probability of achieving them. It helps to dream big, but also be realistic and factor in things like work-life balance, family, and education. This might be something you already do naturally.

Step 2: Find the common skills and front load them: Find the most common and high value skills to learn what you think will benefit you in the pursuit of your end goals. How do you find this? Do you have the right perspective to seize the opportunities right in front of you like volunteering, helping a friend by writing content for a blog post, stepping up in leading the team, shadowing someone, or learning about emotional intelligence. Just getting an opportunity to practice the skills is sometimes the hardest part. You could find what some of these requirements are by looking at job postings to find commonalities. What can you do to put yourself onto a path to get there? For example, if one of the job requirements across all three goals is to be able to “Manage a team of 30 engineers”, how can you take an intermediate step to get you closer to that skill? Maybe you aren’t managing any engineers currently because you are in an individual contributor role. Is there an opportunity to start by mentoring new hire engineers? Then after that, applying to become the team lead for a certain feature? Each step provides you with an opportunity to experience management, which can then lead to you managing a small team and eventually hitting your goal of managing 30 engineers.

Step 3: Choose the opportunities that maximize your chances for success: Choose the opportunities that provide you with a variety of future growth options. This is probably the hardest one to do because it is the marshmallow experiment on steroids (would you like $100,000 today or $10,000,000 at retirement?). Early in my career I saw a lot of people eat the marshmallow early, often chasing money only to end up hating their life, hating their jobs, and working 80-100 hour weeks with no growth prospects. Don’t get me wrong, there is nothing wrong with working hard, but there is more to life than money.

The overall difference in effort is minimal, maybe an initial investment of 2-3 hours per year to charter out a plan and 15-30 minutes per week reflecting on progress, but the benefits compound over time.

The proof is in the binomial pudding. (Warning: Math ahead, proceed at your own risk)

Most investors know about the power of compound interest on asset returns, but we often fail to talk about how compounding applies to our day-to-day decisions. If you spend a few hours learning a new skill, then it will often benefit you for the rest of your life, and also provide you with even more opportunities for growth. The benefits range from higher future earnings to working on bigger and better things, or often both. I can think of one skill in particular that paid dividends in my career. I learned how to use Excel to its full potential early in my career. At the time I had no idea how significant this would be for my evolutionary pathways. Long story cut short, because I had learned that skill, I got offered training to learn SQL and suddenly I was the go-to ‘data’ person at work. This skill subsequently meant I got to go on and learn amazing things about data architecture and enterprise strategy. No part of my formal education included training in SQL and here I was a few short years after University presenting to c-suite executives and/or helping shape the strategy of a company on the other side of the world. To this day I use all of those skills. What this hopefully highlights is the power of compounding when it comes to learning new skills.

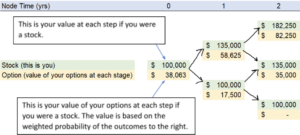

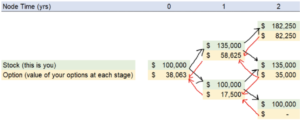

Options theory provides us with a way to quantify these sorts of decisions.The mathematical proof is somewhat irrelevant as a lot of it has been simplified and is conceptual in nature, but for the mathematically minded here is a reminder on the amazing powers of compounding. The theoretical proof for this can be shown using binomial models (meaning something that has two pathways or outcomes). With a little planning and some luck, each opportunity can bring you exponentially closer to your end goal as the probabilities compound (i.e. you do not lose the benefits, experiences, or track record of previous successes with each win). Each of the below charts show the value of you, if you were a stock (shown in green), and the value of the corresponding option (shown in yellow).

Example 1 – Full effort

The example below shows two decisions over two time periods (the technical term for this is a two step binomial model) with a 50:50 chance of a 35% increase at each step. Based on the outcomes at t = 2, the intrinsic value of the option at t = 0 is $38,063. The combined value of the stock (you) and the option at t = 0 is $138,063 or ~38% over and above what you earn today if you had no options. This is a great ROI for something that costs you probably less than 1% of your time and probably much better than anything you might ‘yolo’ on Robinhood.

The way the calculations work is by projecting out the value of the stocks (black arrows) and then working backwards (red arrows) until you get back to t=0.

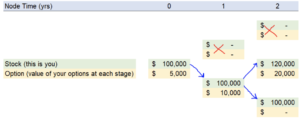

Example 2 – Half effort

The second example is what happens if you take your time learning that new skill and as a result miss a better opportunity. The table has had each input reduced slightly to account for the first period’s growth that was missed (the red crosses show the lost pathway caused by a missed opportunity). Now the upside is 20% as the opportunity isn’t as good and the intrinsic value of the option at t = 0 is only $5000.

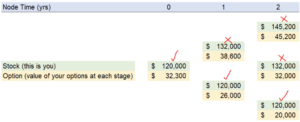

Example 3 – Short term focused

One final example. Let’s model a scenario where a short-term benefit is taken at the expense of subsequent outcomes. This is similar to the marshmallow experiment we mentioned earlier. While you are arguably better off at the start, the combined value of the option and the asset is lower. In fact, the only situations you are better off in is the worst case scenario as shown by the red marks.

Final Thoughts & Questions

I was always shocked at how little guidance we get in formal education frameworks on decision points and how to navigate them. Each option will potentially be an important life decision, and hopefully, this strategy helps you navigate your pathway and the likelihood of ending up deep ‘in the money’. Especially if you are younger with a lot of options ahead of you and a long investment horizon. Such small differences can have such big impacts.

Some of you may try to use this conceptual framework to plan out the next X years. In the event you do, here are some additional things to consider:

- Are the skills/goals you’ve identified going to be relevant and provide you further options X years from now?

- What is your perspective on life right now? Are you seeing the options or opportunities right in front of you?

- What opportunity could you give to someone in your community to give them a shot at a better life/career?

As my Professor in University once told me, don’t let the only stock options in your life be the ones in your soup – chicken or vegetable…